Mike Lawler says Senate offering ‘good deal’ on SALT in Trump tax bill

NEWYou can now listen to Fox News articles!

A key republican from New York said he was satisfied with a tax provision in the Senate of the “Grand and Beautiful Bill” by President Donald Trump after weeks of back and forth.

“I think it’s a very good deal. We were able to keep the language of the house intact,” said representative Mike Lawler, Rn.Y.

“I think that at the end of the day, it’s a [four-times] increase [state and local tax (SALT) deduction caps]. And despite the best efforts in the Senate to reduce the language, we were able to keep it. “”

Lawler is one of the many Blue State Republicans who have threatened to flow the bill if he has not sufficiently raised salt deduction ceilings.

The conservatives of the Chamber go to war with the Senate on the `Grand Bill ” of Trump of Trump

Representative Mike Lawler spoke to Fox News Digital of the Senate salt compromise. (Tierney L. Cross)

Salt deductions aim to relieve people living in high cost areas, mainly in large cities and their suburbs.

There was no limit to the deductions on salt before tax discounts and Trump jobs in 2017 (TCJA), which capped this federal tax advantage at $ 10,000 for single declarations and married couples.

The House bill increased this ceiling to $ 40,000 per 10 years, households showing $ 500,000 eligible for the full deduction.

The Republicans of the Senate, who published their text from the bill just before midnight Friday evening, reduced the window of advantages to five years instead of 10.

After that, the maximum deduction would amount to $ 10,000 for the next five years.

“Yes, the weather has been shortened, but at the end of the day, people will immediately deduce them to $ 40,000, which is a massive victory,” Lawler told Fox News Digital.

“The Democrats have promised to solve this problem when they had total control in ’21 and ’22 and did not manage to deliver. We deliver it. So, you know that it is a big victory for New York. It is a big victory for taxpayers from all over the country.”

The Blue State Republicans, mainly those of New York and California, pushed hard in favor of the lifting of this ceiling. They painted it as an existential political problem in their districts, where republican victories were essential for the victory of the GOP and the majority of his house.

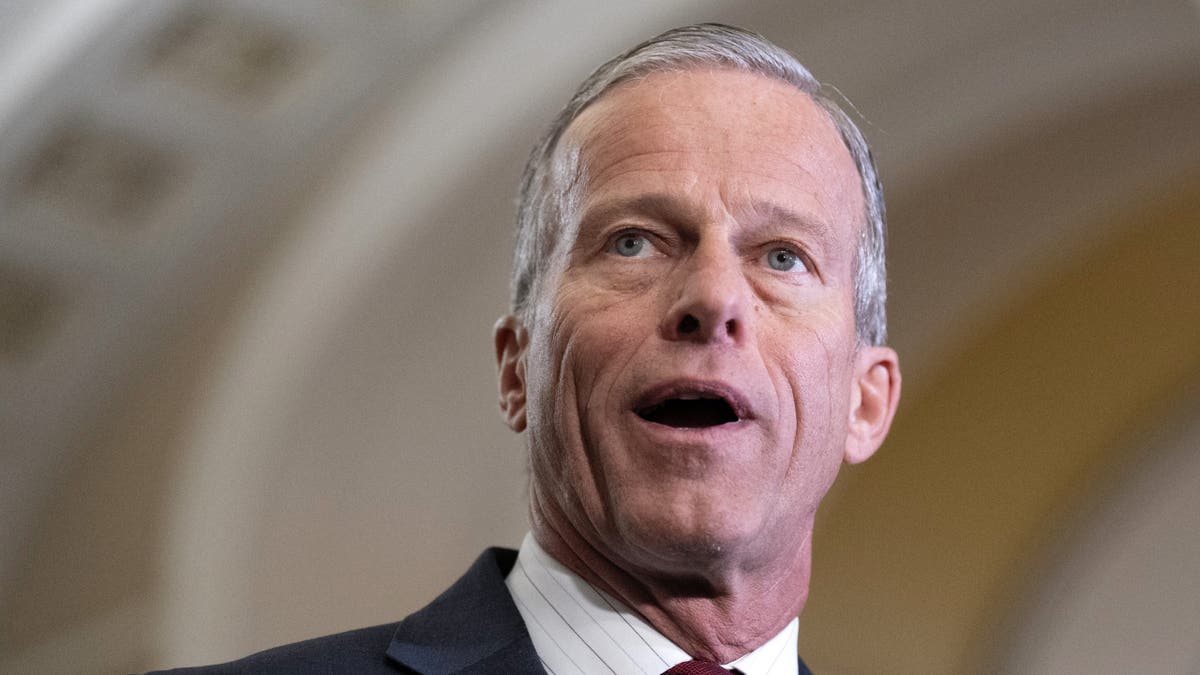

The head of the majority of the Senate, Senator John Thune, inaugurates the bill in his room. (AP photo / Jacquelyn Martin)

They also argued that their states referring more money to the federal government effectively subsidize the lower tax states which do not report as much income.

But the Republicans in more GOP states have rejected deductions from salt as a reward for Democratic States with high taxes to pursue their own policies.

“Salt deductions allow blue states to export their political errors (by electing tax and crazy socialists), the Americans should not subsidize,” wrote Chip Roy representative, R-Texas on X.

Lawler would not say if his support for the agreement meant that he would vote for the final bill – noting that there were other provisions that he should read in the legislation of 940 pages.

Trump’s senior health official slaps for “deceptive” allegations on Medicaid reform

But he said he thought that most of his republican colleagues in Salt Caucus would support the compromise.

“I think there is a large consensus among most of us on the importance of this and what important victory,” said Lawler.

Representative Nicole Maliotakis, RN.Y., the only member of the Salt Caucus who seated the Ways & Means Ways & Means committee of tax writing, told Fox News Digital of the agreement on Friday: “I can live with this, but, frankly, the $ 30,000 over 10 years that I negotiated in ways and means would have protected my constituents for longer.”

“But alas, it’s a group exercise and there are a lot of cooks in the kitchen,” she said.

However, not everyone is on board. Representative Nick Lalota, RN.Y., told Fox News Digital that he rejected the agreement.

Representative Nick Lalota pointed out that he did not think that the salt agreement was quite good. (Getty Images)

“Although I support the president’s wider agenda, I would be hypocritical for me to support the same unjust salt ceiling of $ 10,000 that I spent years criticizing. A permanent deduction ceiling of $ 40,000 with $ 225,000 income thresholds for simple declarants and $ 450,000 for joint declarants would win my vote,” he said in a written statement.

Representative Young Kim, R-Calif., Did not comment on the salt agreement, but said more broadly that his support for the bill depends on how decisions on salt deduction ceilings, Medicaid measures and small businesses take place.

Click here to obtain the Fox News app

A familiar source with her thought told Fox News Digital that she would vote against the bill in the House if the most serious Medicaid cuts in the Senate remained in place.

The Senate aims to start to consider the laws on the prosecution at the end of the afternoon on Saturday, although the final vote can arrive at the early hours of Sunday, if not later.

The bill could also change today, various republican legislators always expressing their concern.

Fox News Digital contacted the co -president of Salt Caucus, Andrew Garbarino, Rn.y., and representative Tom Kean, Rn.j. for comment.