Trump signs his huge tax and spending bill into law

BBC News, in the White House

President Donald Trump signed his bill on historical policy, one day after his accuracy by the congress.

Friday afternoon, the signing event of the White House promotes key Trump agenda, including tax reductions, increases in defense and immigration repression.

There was a festive atmosphere in the White House while Trump signed the bill before the fireworks of the independence day and a military picnic assisted by the pilots who recently stolen in Iran to strike three nuclear sites.

Trump told supporters that he would trigger economic growth, but he must now convince skeptical Americans because the polls suggest that many disapprove of the bills.

Several members of his own republican party have been opposed due to the impact on the increase in American debt and the Democrats warned that the bill would reward the rich and punish the poor.

The 870 -page package includes:

- extend the 2017 tax reductions in Trump’s first mandate

- Straid sections of Medicaid spending, health care program provided by the state for low -income and disabled people

- New tax alternatives on income, overtime and social security

- A budget increase of $ 150 billion for the defense

- A reduction in the tax credits on the own energy of the time of Biden

- 100 billion dollars to immigration and customs application (ICE)

A few moments before the signing of the bill, there was a B-2 bomber thief-the same type of plane which participated in the Iranian operation-flanked by a plane F-35 and F-22 very advanced.

In a White House balcony speech against the South lawn, Trump thanked the Republican legislators who helped inaugurate the bill at his office. He praised tax reductions in the bill, dismissing criticism of the impact on social programs such as food aid and Medicaid.

“The greatest reduction in spending, and yet you will not even notice it,” he said about the bill. “People are happy.”

In addition, Trump has welcomed additional resources given to the application of borders and immigration and the end of taxes on advice, overtime and social security for the elderly, which he says that the bill will fulfill.

The festive mood follows days of tense negotiations with the republican rebels at the congress and days of Cajole on Capitol Hill, sometimes by the president himself.

The head of the House minority, Hakeem Jeffries, delayed the final vote of the Lower Congress Chamber Thursday speaking for almost nine hours.

He described the bill an “extraordinary assault on health care of the American people” and cited testimonies of individuals worried about their impact.

But his marathon speech only postponed the inevitable. As soon as he sat down, the room moved to a vote.

Getty images

Getty imagesOnly two Republicans clashed, joining the 212 united democrats in opposition. The bill was adopted by 218 votes to 214.

Earlier this week, the Senate adopted the bill, but the American vice-president JD Vance was required to vote against three Republicans.

A few hours after the Chamber adopted the bill, the president was in a triumphant mood while he went on stage in Iowa to launch a celebration of a year of 250 years since American independence.

“There could not be a better birthday gift for America than the phenomenal victory we made a few hours ago,” he told the supporters of monks.

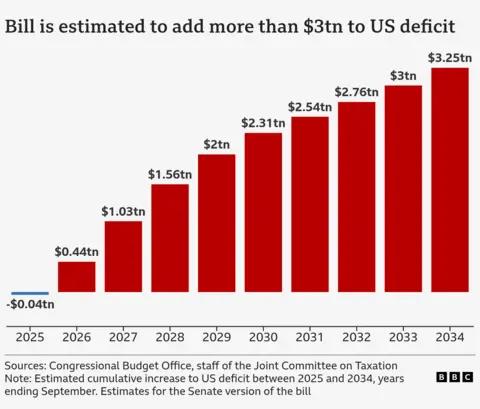

The White House estimates that the various tax reductions will help stimulate economic growth, but many experts fear that this is not enough to prevent the budget deficit – the difference between spending and tax revenue during a year – to swell, adding to national debt.

The analysis of the Congressional Budget Office (CBO) suggests that tax reductions could produce a surplus during the first year, but will then result in a sharp increase in the deficit.

According to the FISM Policy Center, tax changes in the bill would benefit the richer Americans more than those of lower income, around 60% of the advantages would go to those which pay $ 217,000 (£ 158,000), according to its analysis.

The BBC spoke to the Americans who can see a reduction in subsidies that help them pay for the grocery store.

Jordan, father of two children, is one of the 42 million Americans who benefit from the SNAP (additional nutritional aid program) program targeted by the bill.

He and his wife obtain about $ 700 per month to feed their family with four people and the 26 -year -old said that if this bill reduced what he can claim that he would get a second job. “I’m going to make sure I can do everything I can to feed my family,” he said.

In addition to to snap costs, the changes made to Medicaid – a program that covers health care for low -income Americans, the elderly and disabled – would result in nearly 12 million loss of coverage over the next decade, according to CBO estimates.

The Republicans defend their modifications to Medicaid, claiming that by harvesting the work requirements, they approach abuses and fraud.

The survey taken before the bill adopted at Congress suggests that public support is low and overshadowed by opposite figures. A recent survey of the University of Quinnipiac only indicated 29% approving the legislation, which reached two thirds among the Republicans.

But knowledge of the bill can also be low. Reuters reported that there was little conscience of the laws among Trump supporters to whom they spoke at the Iowa rally on Thursday evening.